Following our post, The (Potential) Demise of Auer Deference?, we wrote an expanded article on tax reform and deference for Law360. The Law360 article, “Deference Principles: Tax Litigation’s Next Battleground,” can be accessed here.

read more

Following our post, The (Potential) Demise of Auer Deference?, we wrote an expanded article on tax reform and deference for Law360. The Law360 article, “Deference Principles: Tax Litigation’s Next Battleground,” can be accessed here.

McDermott Will & Emery recently published Issue 3, 2017 of International News, which covers a range of legal developments of interest to those operating internationally.

This issue focuses on the upcoming Brexit from the European Union and the changes in the US Administration; both subjects which have dominated headlines over the past year. This issue explores ways in which prepared investors and businesses can continue to function effectively during this period of uncertainty and change.

Taxpayers can choose whether to litigate tax disputes with the Internal Revenue Service (IRS) in the US Tax Court (Tax Court), federal district court or the Court of Federal Claims. Claims brought in federal district court and the Court of Federal Claims are tax refund litigation: the taxpayer must first pay the tax, file a claim for refund, and file a complaint against the United States if the claim is not allowed. Claims brought in the Tax Court are deficiency cases: the taxpayer can file a petition against the IRS Commissioner after receiving a notice of deficiency and does not need to pay the tax beforehand.

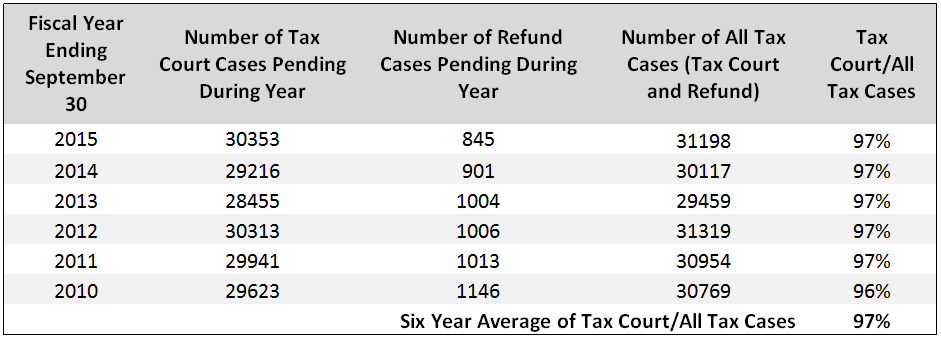

As demonstrated in the chart below, approximately 97 percent of tax claims are instituted in the Tax Court. It should be noted that, after a taxpayer files a petition in Tax Court, the taxpayer no longer has the option of bringing the claim in any other court for the year(s) at issue.

Tax Court Versus Tax Refund Litigation

On March 30, 2017, the US Treasury Inspector General for Tax Administration (TIGTA) published a report identifying numerous violations of taxpayer rights from 2012 to 2014 by the Internal Revenue Service Criminal Investigation Division (IRS CID) in structuring cases. TIGTA examined over 300 investigations for structuring in this time period and identified 21 cases in which taxpayer rights had been compromised.

The Bank Secrecy Act of 1970 (BSA) requires US financial institutions to file reports of currency transactions exceeding $10,000. A provision of the BSA, 31 U.S.C. § 5324(a), prohibits structuring, that is, setting up a transaction for the purpose of evading this reporting requirement. Violations of the law can result in fines, imprisonment and asset forfeiture. This law is administered by the US Department of the Treasury, and one of its major goals is to monitor traffic in illegal-source funds (i.e., funds used in drug transactions or to support terrorism). (more…)