The United States Government Accountability Office (GAO) recently released a report regarding how the Internal Revenue Service (IRS) communicates tax guidance to the public.This report was prepared following bipartisan requests from members of both houses of Congress.

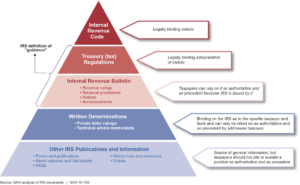

The GAO report: (1) analyzed documents that defined IRS guidance types; (2) reviewed the IRS’s policies and procedures for issuing guidance; (3) reviewed literature on the IRS’s issuance of guidance; (4) interviewed individuals at relevant government and tax practitioner organizations; and (5) reviewed IRS guidance issued during 2013 through 2015. Below is a chart included in the GAO report that illustrates various forms of guidance, and the weight that the IRS says attaches to each.

The GAO found that the IRS uses many different forms of guidance to communicate its interpretation of tax laws to the public, but considers only the Internal Revenue Bulletin (IRB) guidance to be authoritative. The IRS’s statement that only IRB guidance is authoritative could be considered an oversimplification. We previously wrote (here, here, and here) about how deference principles may apply to various forms of guidance.

The GAO found further that while the IRS has detailed procedures for identifying, prioritizing, and issuing new guidance, the IRS lacks procedures for documenting the decision about what form of guidance to issue.

read more

Subscribe

Subscribe