On July 18, 2018, the Internal Revenue Service (IRS) released a Practice Unit advising IRS agents on the framework to follow in analyzing the tax treatment of transaction costs incurred by taxpayers in executing business practices. The latest Practice Unit provides guidance to IRS examiners in determining whether transaction costs must be capitalized or can be immediately deducted, and focuses on the so-called INDOPCO regulations contained in Treasury Regulation § 1.263-5. (For more information and background, see here.)

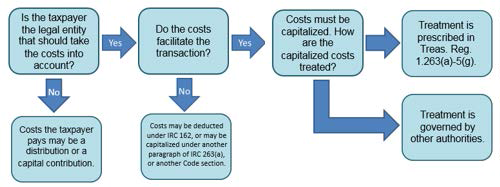

According to the Practice Unit, there is a three-step process applied to analyze a transaction costs issue:

- Determine whether the taxpayer is the proper legal entity to take the transaction costs into account for tax purposes;

- Determine whether the costs facilitate the transaction; and

- Determine how the taxpayer should treat facilitative costs it must capitalize.

The key considerations and outcomes for each step are illustrated in the Practice Unit as follows:

Practice Point: Determining whether transaction costs must be capitalized or can be deducted is sometimes a difficult process. The IRS has attempted to create bright-line rules in this area, but invariably there are factual situations not covered by the INDOPCO regulations and disputes that may arise. Understanding the IRS’s approach to examining transaction costs, as set forth in this Practice Unit, may assist taxpayers under examination in resolving these types of issues.

read more

Subscribe

Subscribe