We frequently write about developments at the US Tax Court, including noteworthy cases, administrative matters, and the status of presidentially appointed Judges and court-appointed Special Trial Judges. One item we have not discussed in the past is the Tax Court’s “Reports & Statistics,” which is available here.

The Reports & Statistics page currently contains two items: (1) Congressional Budget Justification Reports and (2) Appellate Reports. The former contains reports for FY 2021, FY 2022 and FY 2023, and the latter contains, by months, cases commenced in the US Courts of Appeals from July 2020 through March 2022.

The Congressional Budget Justification Reports are submitted to the Committee on Appropriations, Subcommittees on Financial Services and General Government in the US House of Representative and US Senate. The FY 2023 Congressional Budget Justification Report (FY23 Report), submitted February 28, 2022, includes detailed information regarding the operations of the Tax Court and breakdown of its expenses (both prior and anticipated future expenses).

The FY23 Report contains details on the Tax Court’s response to the COVID-19 pandemic and the substantial increase in petitions filed in FY 2021 (35,297 petitions, up from the historical average of between 23,000 and 26,000 petitions). The report also discusses the court’s use of in-person and remote proceedings over the past two years, noting that the success of remote proceedings and the move to institutionalize remote proceedings post-pandemic.

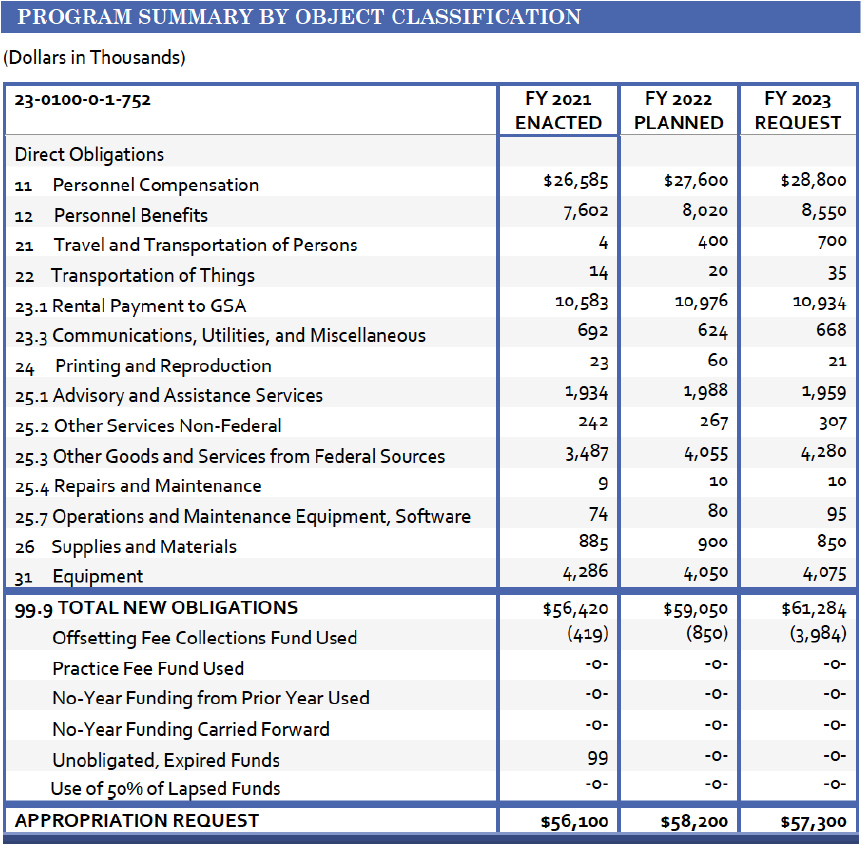

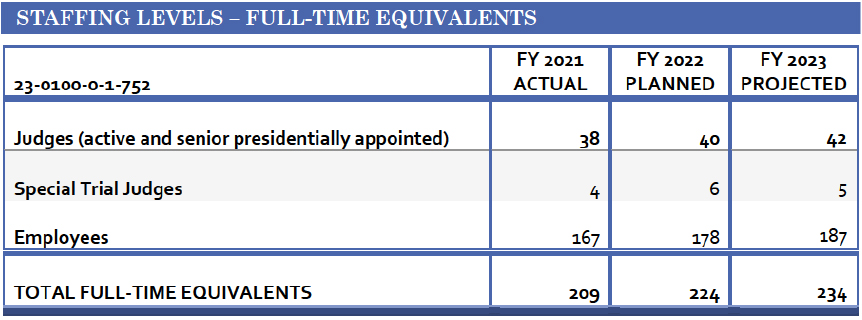

For FY 2023, the Tax Court requested a budget of $57,300,000. This constitutes a 1.6% decrease from the FY 2022 requested budget. The following charts reflect prior and current requests and staffing levels.

A few other points are worth mentioning. The FY23 Report indicates that the Tax Court does not plan on holding a Judicial Conference in 2023 due to ongoing uncertainties relating to the COVID-19 pandemic (the last Judicial Conference was held in FY 2018). The FY23 Report also discusses the status of the Limited Entry of Appearance procedures that started in September 2019 and mentions certain legislative proposals submitted to Congress for fee proposals (e.g., raising the fee for filing a petition from $60 to $100). Finally, the FY23 Report notes that there are two vacancies for judicially appointed Judges (we note that currently no individuals have been nominated for these vacancies).

Practice Point: The FY23 Report contains detailed information about the Tax Court. It is worth a quick read for those who practice in the Tax Court or are interested in learning more about the Court’s operations.

read more

Subscribe

Subscribe