On September 7, 2017, the Treasury Inspector General for Tax Administration (TIGTA) issued a report about the Internal Revenue Service’s (IRS) Freedom of Information Act (FOIA) procedures. After reviewing a statistically valid sample of FOIA requests, TIGTA concluded that the IRS improperly withheld information 14.3 percent of the time—or approximately 1 in 7 FOIA requests.

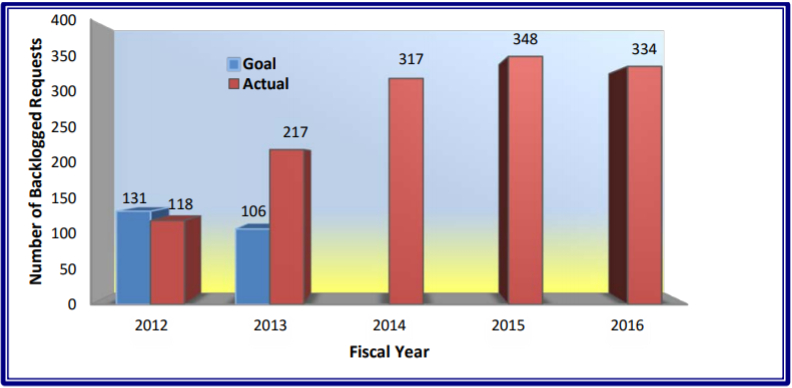

TIGTA also found that at the end of Fiscal Year 2016, there were 334 backlogged information requests. Below is a chart from the report showing the IRS’s recent history of backlogged FOIA requests.

TIGTA’s findings are consistent with our experiences with FOIA requests. It is not unusual for the IRS to make repeated requests for extensions to respond. We note further that, during an examination, the IRS is statutorily authorized to provide taxpayers access to their administrative file. Indeed, the Internal Revenue Manual confirms this at section 4.2.5.7 (June 15, 2017). Yet the IRS examination team often requires a FOIA request.

Practice Point 1: As a result of the IRS’s FOIA backlog, some taxpayers have resorted to filing lawsuits in federal district court to enforce their FOIA rights. Because the IRS must respond to court deadlines, taxpayers are sometimes able to force a more expedient response and move to the front of the response line.

Practice Point 2: Taxpayers should attempt to tailor their FOIA requests, only requesting the information in which they are interested. In theory, this could make the IRS’s job easier and, in turn, responses more timely.

Practice Point 3: If taxpayers intend to seek information from the government through the FOIA process, they should do so as soon as possible (e.g., at the beginning of the examination process) so that they may get the information in time to be useful.