The United States Government Accountability Office (GAO) recently released a report regarding how the Internal Revenue Service (IRS) communicates tax guidance to the public.This report was prepared following bipartisan requests from members of both houses of Congress.

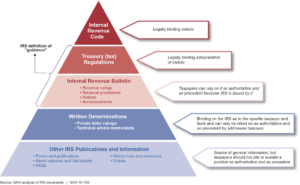

The GAO report: (1) analyzed documents that defined IRS guidance types; (2) reviewed the IRS’s policies and procedures for issuing guidance; (3) reviewed literature on the IRS’s issuance of guidance; (4) interviewed individuals at relevant government and tax practitioner organizations; and (5) reviewed IRS guidance issued during 2013 through 2015. Below is a chart included in the GAO report that illustrates various forms of guidance, and the weight that the IRS says attaches to each.

The GAO found that the IRS uses many different forms of guidance to communicate its interpretation of tax laws to the public, but considers only the Internal Revenue Bulletin (IRB) guidance to be authoritative. The IRS’s statement that only IRB guidance is authoritative could be considered an oversimplification. We previously wrote (here, here, and here) about how deference principles may apply to various forms of guidance.

The GAO found further that while the IRS has detailed procedures for identifying, prioritizing, and issuing new guidance, the IRS lacks procedures for documenting the decision about what form of guidance to issue.

The GAO made six recommendations—the first four recommending IRS action and the final two recommending action from the Office of Management and Budget (OMB) and the Treasury:

- Communicate more clearly the limitations of information not published in the IRB to taxpayers;

- Amend current policies and procedures for drafting guidance to include factors to consider when deciding what type of guidance to issue and procedures for documenting those decisions internally;

- Develop policies and procedures to help guidance-drafting teams assess whether non-regulatory guidance should be considered a rule for purposes of the Congressional Review Act (CRA) and in turn “major,” and document those assessments internally. The CRA requires agencies to submit certain rules to Congress and the Comptroller General before they can take effect. If the rule is determined to be “major” the GAO will issue a report to Congress summarizing and assessing the agency’s compliance with required procedural steps;

- Take action to ensure that required steps are consistently documented during key phases of the non-regulatory guidance process;

- Examine the relevance of the long-standing agreement that exempts certain IRS regulations from executive order requirements (see #6 below) and Office of Information and Regulatory Affairs (OIRA) oversight; and if relevant, make publicly available any reaffirmation of the agreement and the reasons for it. OIRA, an organization within OMB, is responsible for determining whether a rule covered by the CRA is “major”; and

- Develop a process to ensure that OIRA has the information necessary to determine whether IRS rules are “major” under CRA and “significant” under Executive Order 12866. If a rule is determined to be significant, OIRA review of the IRS rule is required.

The GAO report and its recommendations may lead to more formal procedures and clarity for the IRS’s release of guidance. This would be a welcome development for taxpayers.